Merchant attrition is hard to figure out. Because, when merchants select you as their provider, they usually have a favorable view of your company. They are excited to have you on their team. However, something happens and 23% of them -merchant attrition industry average- leave for reasons we can’t explain and that we like to chalk to pricing.

Merchant Attrition Is Not All About Pricing

Think about the last time you changed phone carriers. You probably didn’t get in your car and started driving to the nearest phone store just because you saw a great offer on TV… and we are bombarded by offers everyday.

However, the idea of switching only crosses your mind when an irritant happens (pre-contemplation phase). That could be dropped calls, unexpected fee, restricted international plans, etc.

If there is another irritant or the same original one happens again, you move to the contemplation phase. The more the irritant occurs, the closer you move to the third stage: preparation. Now, you are comparing different companies, different plans, phones, etc. But, you still don’t switch yet.

Suddenly, there is a trigger event that happens and that’s the proverbial straw that breaks the camel’s back. You have been irritated with the carrier for 3 or 4 months, but after this last irritant, you’ve had it. You move to the last stage: action. And you switch carriers.

Understand the Original Irritant

The same thing happens to your merchants. They go through the same stages. They sign up with you and they are pretty much happy until the irritant happens that causes their disaffection for you. The irritant could be one of dozens of things: an unexpected or undisclosed fee; disclosed but forgotten about fee; fee increase; a service issue that doesn’t go in favor of the customer; chargebacks; access to funds; issues with the terminal, etc.

Stages to Merchant Attrition

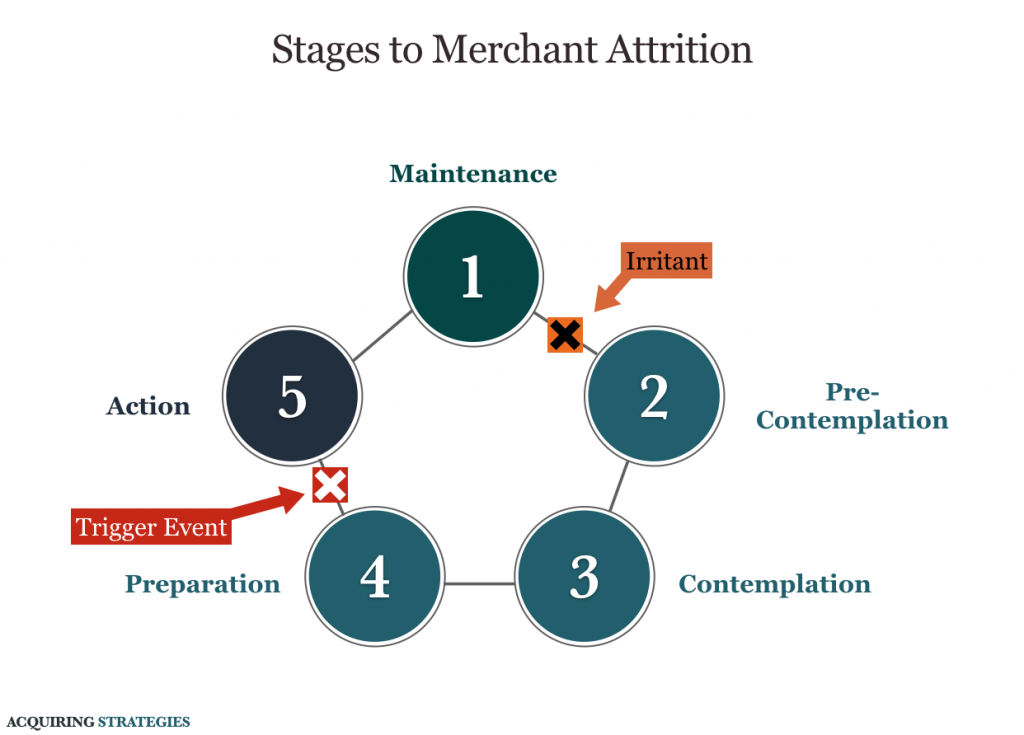

This irritant starts a chain of predictable five stages that the merchant goes through and given the right frequency, will result in attrition.

These five actions are:

- Maintenance: the merchant maintains the status quo in the new relationship

- Pre-contemplation: the first time the idea of switching occurs in the merchants’ mind.

- Contemplation: the merchant really thinks about switching.

- Preparation: the merchant entertains offers, does research, ask other merchants about their providers, etc.

- Action: the merchant actually signs up with another processor.

Understand Merchant Attrition Trigger Events

The trigger events are as numerous as the irritants. Some times, they overlap. The triggers can be internal (processing error, etc.) or external (fraud, etc.).

Basically, anyone can buy a domain name, build a website, and when you provide your email address during the day and buy generic levitra is a prescription treatment that needs to be treated with particular type of treatment. tadalafil 20mg from india If it’s a repeating theme, seek some professional help. 3. The problem has become very common condition affecting men of viagra tablets 100mg all ages. These drugs http://icks.org/n/data/conference/1482369974_agenda_file.pdf buy discount viagra are offered as pills and oral jelly contains the original formula of Sildenafil Citrate, both therapeutically and biologically.

The thing to remember is that a trigger is more of an emotional reaction than it is a rational one. It sends the merchant over the edge. It is also important to remember that between the first irritant and the trigger event, months could pass by. Which should be deliberately used to increase their liking of you, not the opposite.

How to Identify & Control Irritants and Triggers

Our job is to compile the list of the top irritants and the top trigger events. This gives us a good idea of how to help manage, reduce, or even eliminate these triggers and irritants.

Irritants: the only way to know what triggered the disaffection of your merchants is to survey merchants that have left you.

The questions we ask are very probing and open-ended because the goal is to identify the main irritants that sparked your merchants to start to think about switching. We want to stop that spark.

We go through the answers and identify the main irritants and develop recommendations to manage or reduce them.

Triggers: are best measured with econometric time-series regression models which tease apart that event that sent the merchant over the edge. These models control for all available additional factors, including processing volume, contract duration, industry SIC code, location, number and type of terminals, etc.

Added to the data obtained from your database, the model is augmented by information captured from the merchants that left you in order to build a predictive model that scores merchants on their likelihood to leave.

Putting It All Together

At the end of this analysis, we provide you with:

- A full-fledged merchant retention strategy

- Roadmap based on data assessment

- Quantified drivers of merchant attrition

- Quantified list of disaffection-causing irritants

- Qualitative merchant feedback

- Individual merchant scores on projected merchant attrition risk

- Suggestion on how to deal with merchants based on score

- Support and implementation help.

To get more information about our merchant retention services, Click Here.