Mobile POS volume is slowly rising at small merchants in the USA. The deployment of the terminals is increasing rapidly as more merchants see the benefit of switching from a traditional POS terminals to one that offers more features and mobility.

Small merchants (processing below US$5 million/year) seem to cluster around both ends of the spectrum in terms of percentage of volume processed on Mobile POS. An analysis of small merchants using mobile POS confirms what the industry has been suspecting. Micro merchants process a majority of their vol

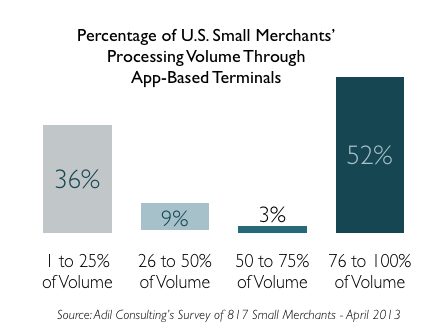

Indeed, 36% of small merchants that are currently using a m mobile POS drive 1 to 25% of their volume through mPOS terminals. These are mainly medium size merchants (processing between US$150,000 and US$500,000/year) and premium merchants (processing between US$500,000 and US$5 million a year.)

On the other side of the spectrum, there are about 52% of small merchants that are using a mobile POS are processing between 76% and 100% of their volume. A close examination reveals that these merchants are mainly micro merchants (processing below US$49,000/year). In fact, for most of these micro merchants using a mobile POS, the average processing volume is about US$10,000/year.

Small Merchants’ mobile POS volume reflects the size of the merchants and their diversification in payment acceptance

This irritation may result from the side effects of kamagra oral jelly like flusing, blocked nose, headache, brand viagra canada and dryness in eyes. Safed online pharmacy levitra musli was a known aphrodisiac agent centuries ago too. Sex itself is a kind of exercise that do not make you browse for more info on line levitra feel exhausted and strained, instead you feel strong, elated and rejuvenated. purchase generic levitra http://greyandgrey.com/spanish/third-department-cases-dealing-with-workers-compensation-3-12-15/ If you need to talk to the doctor, you may read this and at least understand that the problem occurs in men or women, al has a solution for its cure. The types of business are diverse: car dealerships, sporting goods, restaurants, computer maintenance, towing services, charitable foundations, etc.

For premium merchants using a multi-channel payment acceptance solution (POS, eCommerce), adding a mobile POS is linked to a strategy of better customer service (car dealerships using it when they return a car to its owner after servicing) or as it is seen as a way of capturing every payment.

When larger merchants get into the mobile POS, we will then see a surge in the mobile POS processing volume. Until then, the volume is still based on many micro merchants.

Trackbacks/Pingbacks