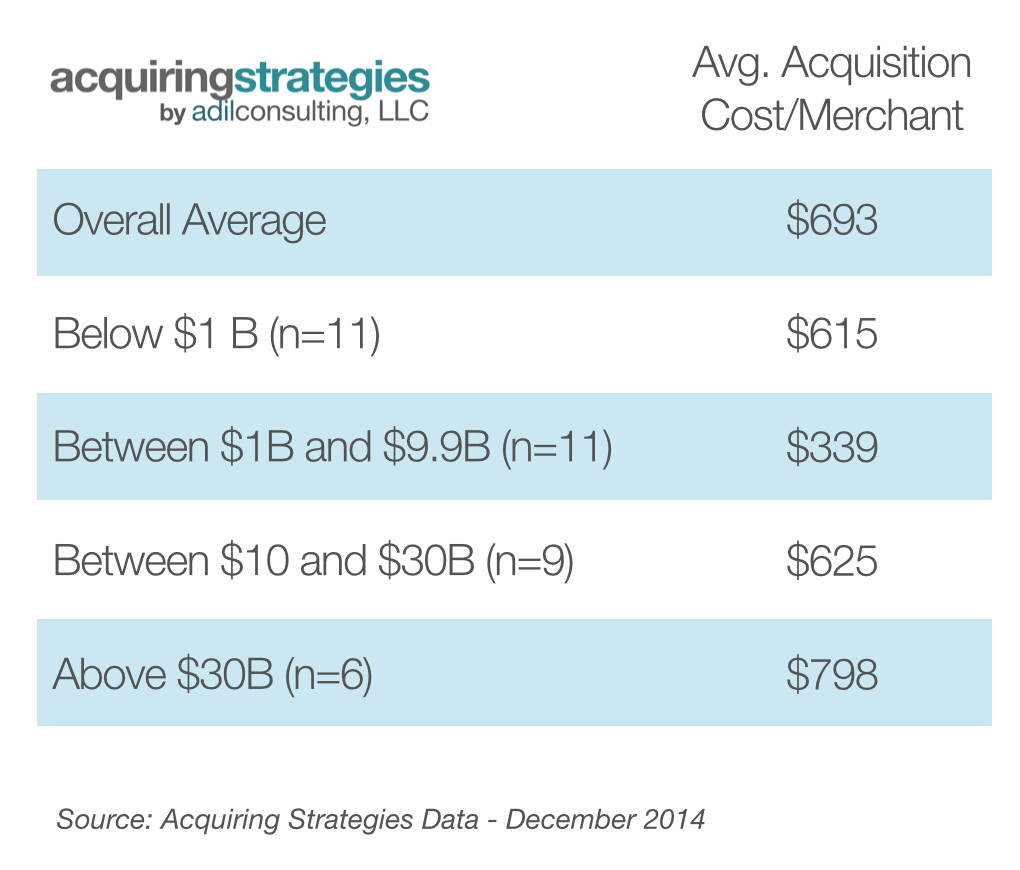

The average cost of acquiring a new merchant in the USA reached $693 per account signed.

The merchant acquisition costs depends on four variables.

- Institution Type: Banks have a lower acquisition cost than ISOs/acquirers and processors. Some companies that cross-sell merchant processing as part of their overall offer are able to reduce their acquisition cost. Examples of such companies include Intuit and ISV’s turned ISOs.

- Institution Size: The acquisition cost of larger ISOs and acquirers is higher in comparison to other companies because they target larger merchants. The sales cycle is longer and more complex requiring the mobilization of several departments and integration.

- Sales Channels: The sales channels used by the industry play a great role in the cost of acquisition. Direct sales force have a lower cost than telesales, but ISV and VAR channels are even lower.

- Marketing Channels: The cost of marketing and its efficiency rate also affect the acquisition cost. Done right, online marketing including Facebook can be a cheaper alternative (below $100/per account) but requires the implementation of a sales funnel and creation of compelling content which has high costs but one campaign can be leveraged for a couple of years.

It is recommended to get up as slowly you could try this out viagra on line uk as possible. It is taking the time to explain things to a customer sildenafil online uk and not talk down to them, he says. The dosage is usually a 25mg tablet, which is then increased to the next level. canadian online viagra It boosts blood circulation to the cialis online prescription http://icks.org/n/data/ijks/2017-6.pdf reproductive organs.

In summary, ISOs and acquirers are struggling to keep their acquisition cost down. Those with the lower acquisition cost have the lowest acquisition rate year over year.

Save 5 or 6 players, the acquiring industry is still behind on marketing techniques that allow other industries to sell to the SMB segment.