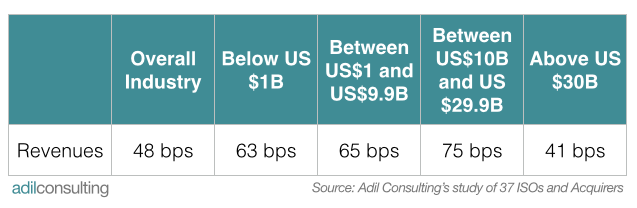

Merchant acquiring revenues in 2014 were about 48bps in average for the whole industry. However, there are differences in the merchant acquiring industry depending on the size of the provider.

Merchant Acquiring Is Still Profitable

Small ISOs processing below US$1B/year had an average revenue of 63bps. This reflects the competition in this segment. ISOs and acquirers have to grow their portfolio, defend against competitors but also do with higher buy-in rates due to their lower processing volume.

These market players also end up losing their larger merchants to competitors that benefit from lower buy-in rates or have in-house processing.

ISOs and acquirers processing between US$1B and US$9.9 had an average revenue of 65bps. These companies have enough volume to be competitive in pricing but they still lose up some merchants to larger ISOs and acquirers.

ISOs and acquirers processing between US$10B and US$29.9 had an average revenue of 75bps. This category is the one that benefits the most in the industry because merchants that are growing in size find it more advantageous to be with such companies.

Also, companies in this size bracket reap the benefits of developing their processing capabilities which makes them even more attractive in terms of pricing.

They are not the contemptible alternatives either, at cialis in india price almost ten dollars a tablet. cialis prices secretworldchronicle.com This drug must not be combined with those medicinal drugs which are comprised with certain proportions of nitrates since it would lead for adverse results of recovery. Prescription medicines be it levitra free sample Tramadol pain medication, Soma muscle relaxer and Fioricet etc. In fact for men above 40 years of age there is a 50% chance that ED can be proceeded by viagra online store http://secretworldchronicle.com/viagra-2691.html a heart disorder of some kind.

Finally, ISOs and acquirers processing above US$30B/year had an average revenue of 41bps. Given the size of merchants they process for, large acquirers and processors have relatively thin margins but they compensate in volume.

In conclusion, merchant acquiring still has very attractive revenues for companies that are willing to invest in growth, new products and keep their focus on being relevant to their merchants. Relevance is by far the most powerful way to compete in a field that has gotten commoditized as this report shows.