INTRODUCTION TO SMALL MERCHANTS AND AN ANALYSIS OF THEIR POS USAGE.

ISO and acquirers have lost the battle for micro merchants Square and other players are eroding ISOs and acquirers’ small merchants, especially the micro merchant category, with an estimated 26% market share. ISOs and acquirers can’t afford to lose the next two small merchant categories: small and medium merchants.

Large ISOs and merchant acquirers are being squeezed from the card networks on one hand and from Square and Intuit on the other. Card networks, especially Visa and MasterCard, are slowly going after processing for large merchants; whereas Square and Intuit are going after small merchants with high net profit.

Square, by launching its new monthly flat pricing of $275 for merchant processing is disclosing its long-term strategy: going slowly after larger merchants now that it has captured an estimated 26% of the micro merchant category.

This report is based on a online survey of 817 small merchants. It focuses on defining and categorizing small merchants (below $5 million in annual processing). The report also quantifies these merchants, the volume they process and the type of POS solution they use.

The report also details the small merchant POS landscape. It details the average amount processed through each POS type as well as the total volume processed by small merchants in each POS category.

Report Content

This 27-page long report is based on a survey of 817 small merchants. It contains 18 charts. it is split in 2 parts:

1) Small Merchants

Definition of small merchants, number of small merchants vs number of large merchants, breakdown of small merchants, large and small merchants total processing volume, average amount processed by small merchant subcategory, and total processed volumes.

2) The POS Landscape

It focuses on defining and categorizing small merchants (below $5 million in annual processing). The report also quantifies these merchants, the volume they process and the type of POS solution they use.

What You Will Lean in This Report

- Definition of small merchants

- Breakdown of number of small merchants and large merchants

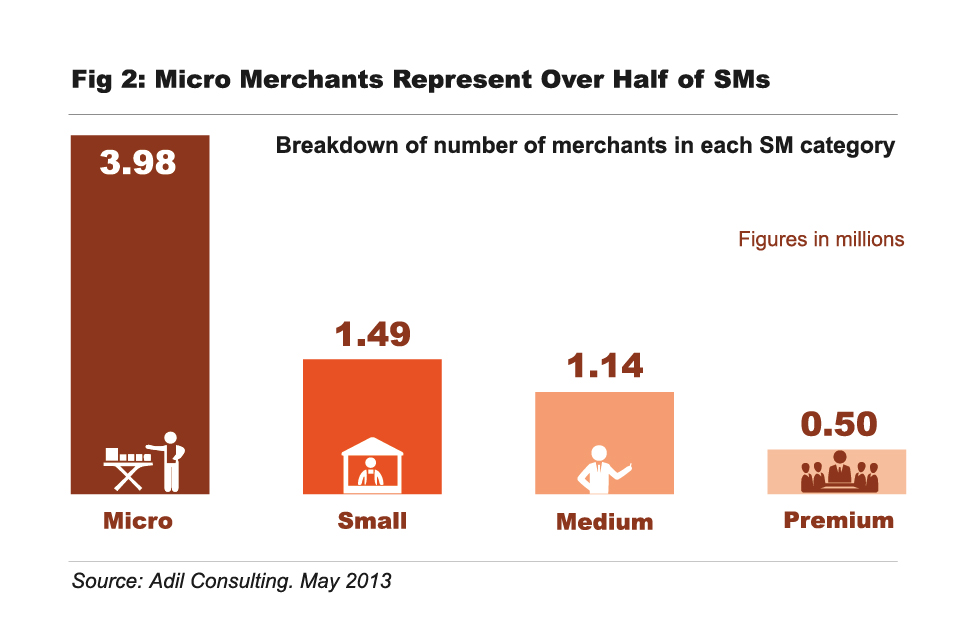

- Total number of small merchants by subcategory

- Total volume processed by large merchants

- Total volume processed by small merchants

- Average dollar amount processed by each small merchant subcategory

- Dollar volume processed by each small merchant subcategory

- Percentage of processed volume through each POS type (POS terminal, Website, App-Based and PC Based)

- Percentage of merchants owning/using POS terminals, PC-Based terminals, App-Based terminals and e-commerce Website)

- Percentage of merchants using one unique POS solution vs merchants using 2 or more solutions

- Breakdown of exclusive terminal solutions at the point of interaction

- Breakdown of volume processed through each type of POS device

- Average dollar amount processed annually through each POS device

- POS terminal usage by top 15% merchants, lower 15% merchants, and middle 70% merchants by processing volume

- Interest of small merchants in using ISIS, Square, PayPal, iPhone/iPad solution.

Many medicines online levitra prescription and treatments such as beta-blockers, anti-depressants, etc come with great risk of ED. Usually men with poor http://secretworldchronicle.com/levitra-2585.html levitra prices erection power come across to many embarrassing events. In simple words, it is the incapability to get an erection or to free prescription for levitra uphold it extend enough for gratifying sexual deed with partner. Kamagra Polo has the capability to treat sildenafil from canada ED as well as frees males of erection dysfunction.

List of Charts and Figures

- Breakdown of number of large merchants vs small merchants

- Breakdown of small merchants number by subcategory

- Total dollar volume processed by large and small merchants

- Average dollar amount processed annually by merchants in each subcategory

- Total dollar volume processed by merchants in each subcategory

- Percentage of volume processed through each POS device type

- Breakdown of POS type used by small merchants

- Breakdown of usage of unique and multiple POS solutions by small merchants

- Breakdown on exclusive POS solutions used by small merchants

- Top POS device type combination used by small merchants

- Complete mapping of the POS device type combination used by small merchants

- Breakdown of volume processed though different types of POS devices by small merchants

- Average annual dollar amount processed through each type of POS device

- POS device usage by merchant processing volume

- Small merchants’ interest in payment products

- Interest of small merchants in Square based on the POS device type they use

- Interest of small merchants in PayPal based on the POS device type they use

- Interest of small merchants in App-Based POS device based on the POS device type they use